Blanket Tax Exemption Form Ohio . State of ohio department of taxation sales and use tax blanket exemption certificate. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Do not send this form to the streamlined sales tax governing board. Sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax unit exemption certifi cate. Streamlined sales tax certificate of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal. This exemption certificate is used to claim exemption or exception on a single purchase.

from www.exemptform.com

Sales and use tax unit exemption certifi cate. State of ohio department of taxation sales and use tax blanket exemption certificate. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Streamlined sales tax certificate of exemption. This exemption certificate is used to claim exemption or exception on a single purchase. Sales and use tax blanket exemption certificate. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Do not send this form to the streamlined sales tax governing board.

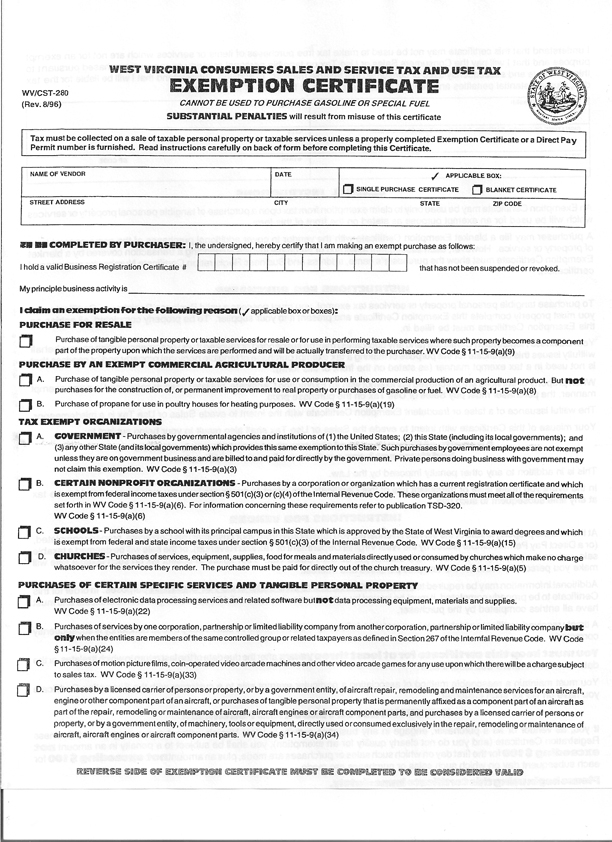

Wv Farm Tax Exemption Form

Blanket Tax Exemption Form Ohio Sales and use tax unit exemption certifi cate. Do not send this form to the streamlined sales tax governing board. Sales and use tax unit exemption certifi cate. State of ohio department of taxation sales and use tax blanket exemption certificate. This exemption certificate is used to claim exemption or exception on a single purchase. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Streamlined sales tax certificate of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the.

From superagc.com

Ohio Farm Sales Tax Exemption Form Tax New tax Available, Act Fast Blanket Tax Exemption Form Ohio Sales and use tax unit exemption certifi cate. This exemption certificate is used to claim exemption or exception on a single purchase. Streamlined sales tax certificate of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal. State of ohio department of taxation. Blanket Tax Exemption Form Ohio.

From www.exemptform.com

Form St 101 Sales Tax Resale Or Exemption Certificate Form Idaho Blanket Tax Exemption Form Ohio Sales and use tax blanket exemption certificate. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Streamlined sales tax certificate of exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Do. Blanket Tax Exemption Form Ohio.

From www.exemptform.com

FREE 10 Sample Tax Exemption Forms In PDF Blanket Tax Exemption Form Ohio Streamlined sales tax certificate of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. Do not send this form to the streamlined sales tax governing board. Sales and use tax blanket. Blanket Tax Exemption Form Ohio.

From www.prosecution2012.com

Ohio Blanket Exemption Certificate Instructions prosecution2012 Blanket Tax Exemption Form Ohio State of ohio department of taxation sales and use tax blanket exemption certificate. This exemption certificate is used to claim exemption or exception on a single purchase. Sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Do not send this form to the streamlined sales tax governing board. Streamlined. Blanket Tax Exemption Form Ohio.

From tutore.org

Get Tax Certificate Master of Documents Blanket Tax Exemption Form Ohio The purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax blanket exemption certificate. Streamlined sales tax certificate of exemption. State of ohio department of taxation sales and use tax blanket exemption certificate. Sales and use tax unit exemption certifi cate. This form allows purchasers to claim exception or exemption on all purchases of. Blanket Tax Exemption Form Ohio.

From printableformsfree.com

Printable Certificate Of Exemption Form Washington State Printable Blanket Tax Exemption Form Ohio The purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax blanket exemption certificate. State of ohio department of taxation sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax unit exemption certifi cate. Streamlined sales tax certificate of exemption.. Blanket Tax Exemption Form Ohio.

From www.signnow.com

Tax Exempt Form 2350 Fillable Fill Out and Sign Printable PDF Blanket Tax Exemption Form Ohio Sales and use tax unit exemption certifi cate. Sales and use tax blanket exemption certificate. The purchaser hereby claims exception or exemption on all purchases of tangible personal. This exemption certificate is used to claim exemption or exception on a single purchase. Streamlined sales tax certificate of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible. Blanket Tax Exemption Form Ohio.

From www.prosecution2012.com

Ohio Blanket Exemption Certificate Instructions prosecution2012 Blanket Tax Exemption Form Ohio Do not send this form to the streamlined sales tax governing board. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax blanket exemption certificate. State of ohio department of taxation. Blanket Tax Exemption Form Ohio.

From www.exemptform.com

State Of Ohio Tax Exempt Form Fill Online Printable Fillable Blank Blanket Tax Exemption Form Ohio Streamlined sales tax certificate of exemption. Sales and use tax unit exemption certifi cate. Do not send this form to the streamlined sales tax governing board. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. A sales tax exemption certificate can be used by businesses (or in. Blanket Tax Exemption Form Ohio.

From printableformsfree.com

Blank Fillable Ohio Tax Exempt Form Printable Forms Free Online Blanket Tax Exemption Form Ohio Streamlined sales tax certificate of exemption. Sales and use tax unit exemption certifi cate. State of ohio department of taxation sales and use tax blanket exemption certificate. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The purchaser hereby claims exception or exemption on all. Blanket Tax Exemption Form Ohio.

From printableformsfree.com

Free Fillable Ohio Tax Exempt Form Printable Forms Free Online Blanket Tax Exemption Form Ohio Do not send this form to the streamlined sales tax governing board. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Sales and use tax unit exemption certifi cate. Streamlined sales tax certificate of exemption. State of ohio department of taxation sales and use tax blanket exemption certificate. This exemption certificate is used to claim exemption. Blanket Tax Exemption Form Ohio.

From www.pdffiller.com

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller Blanket Tax Exemption Form Ohio This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. The purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of tangible personal. Streamlined sales tax certificate of exemption. Do not send this form to. Blanket Tax Exemption Form Ohio.

From www.pinterest.com

Pa Sales Tax Exemption Form PDF Tax, Sales tax, Form Blanket Tax Exemption Form Ohio Sales and use tax unit exemption certifi cate. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Streamlined sales tax certificate of exemption. The purchaser hereby claims exception or exemption on all purchases of tangible personal. The purchaser hereby claims exception or exemption on all purchases of. Blanket Tax Exemption Form Ohio.

From propertytaxrate.blogspot.com

Ohio Sales Tax Blanket Exemption Form 2021 Blanket Tax Exemption Form Ohio State of ohio department of taxation sales and use tax blanket exemption certificate. Sales and use tax unit exemption certifi cate. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Do not send this form to the streamlined sales tax governing board. This exemption certificate is used. Blanket Tax Exemption Form Ohio.

From www.vrogue.co

Blanket Certificate Of Exemption Ohio Form Fill Out A vrogue.co Blanket Tax Exemption Form Ohio A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Streamlined sales tax certificate of exemption. This exemption certificate is used to claim exemption. Blanket Tax Exemption Form Ohio.

From forms.utpaqp.edu.pe

Gsa Missouri Tax Exempt Form Form example download Blanket Tax Exemption Form Ohio A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. This form allows purchasers to claim exception or exemption on all purchases of tangible personal property and selected services from a vendor. Streamlined sales tax certificate of exemption. Sales and use tax blanket exemption certificate. Do. Blanket Tax Exemption Form Ohio.

From www.exemptform.com

Form St 101 Sales Tax Resale Or Exemption Certificate Form Idaho Blanket Tax Exemption Form Ohio This exemption certificate is used to claim exemption or exception on a single purchase. Do not send this form to the streamlined sales tax governing board. The purchaser hereby claims exception or exemption on all purchases of tangible personal. State of ohio department of taxation sales and use tax blanket exemption certificate. This form allows purchasers to claim exception or. Blanket Tax Exemption Form Ohio.

From www.slideshare.net

Ohio tax exemption form Blanket Tax Exemption Form Ohio This exemption certificate is used to claim exemption or exception on a single purchase. Sales and use tax blanket exemption certificate. Streamlined sales tax certificate of exemption. A sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the. The purchaser hereby claims exception or exemption on all. Blanket Tax Exemption Form Ohio.